vermont income tax rate 2020

The 55 corporations would have paid a collective total of 85 billion for the year had they paid that rate on their 2020 income. The IRS will start accepting eFiled tax returns in January 2020 - you can start your online tax return today for free with TurboTax.

Vermont Income Tax Calculator Smartasset

Virginia Tax Brackets 2020 - 2021.

. W-4VT Employees Withholding Allowance Certificate. Both Oklahomas tax brackets and the associated tax rates were last changed six years prior to 2020 in 2014. Vermont School District Codes.

California state income tax rate table for the 2020 - 2021 filing season has nine income tax brackets with CA tax rates of 1 2 4 6 8 93 103 113 and 123. In Oklahoma different tax brackets are. Interest shall be imposed per annum on all unpaid income tax unpaid estimated income tax and unpaid withholding tax.

There are -776 days left until Tax Day on April 16th 2020. The top marginal individual income tax rate was permanently increased from 49 to 59 with the addition of a new bracket. Both New Jerseys tax brackets and the associated tax rates were last changed two years prior to 2020 in 2018.

2021 Income Tax Withholding Instructions Tables and Charts. 2019 VT Rate Schedules. IN-111 Vermont Income Tax Return.

New Jersey has seven marginal tax brackets ranging from 14 the lowest New Jersey tax bracket to 1075 the highest New Jersey tax bracket. The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year. Oklahoma has six marginal tax brackets ranging from 05 the lowest Oklahoma tax bracket to 5 the highest Oklahoma tax bracket.

Arizonas maximum marginal income tax rate is the 1st highest in the United States. As such the statutory corporate income tax rate in the United States including an average of state corporate income taxes is 257. The Tax Cuts and Jobs Act TCJA reduced the US.

In April 2021 New Yorks highest tax rate changed with the passage of the 20212022 budget. Each marginal rate only applies to earnings within the applicable marginal tax bracket. Instead they received 35 billion in tax rebates.

However corporations operating in the United States face another layer of corporate income tax levied by states. Federal corporate income tax rate from 35 percent to 21 percent. 2020 VT Rate Schedules.

This page provides detail of the Federal Tax Tables for 2020 has links to historic Federal Tax Tables which are used within the 2020 Federal Tax Calculator and has supporting links to each set of state. 2020 VT Tax Tables. Flat rate applies to all incomes.

Ohio Revised Code 71827 requires the Tax Administrator to publish by October 31st the established interest rate for tax underpayments based on the federal short-term rate that will apply during the next calendar year. Looking at the tax rate and tax brackets shown in the tables above for Virginia we can see that Virginia collects individual income taxes similarly for Single versus Married filing statuses for example. 2020 California tax brackets and rates for all four CA filing statuses are shown in the table below.

We can also see the progressive nature of Virginia state income tax rates from the lowest VA tax rate bracket of 2 to the highest VA tax. PA-1 Special Power of Attorney. Each marginal rate only applies to earnings within the applicable marginal tax bracket which are the same in New.

Their total corporate tax breaks for 2020 including 85 billion in tax avoidance and 35 billion in rebates comes to 12 billion. The previous 882 rate was increased to three graduated.

Per Capita Sales In Border Counties In Sales Tax Free New Hampshire Have Tripled Since The Late 1950s While Per Capita Sales In Big Sale Clothing Store Design

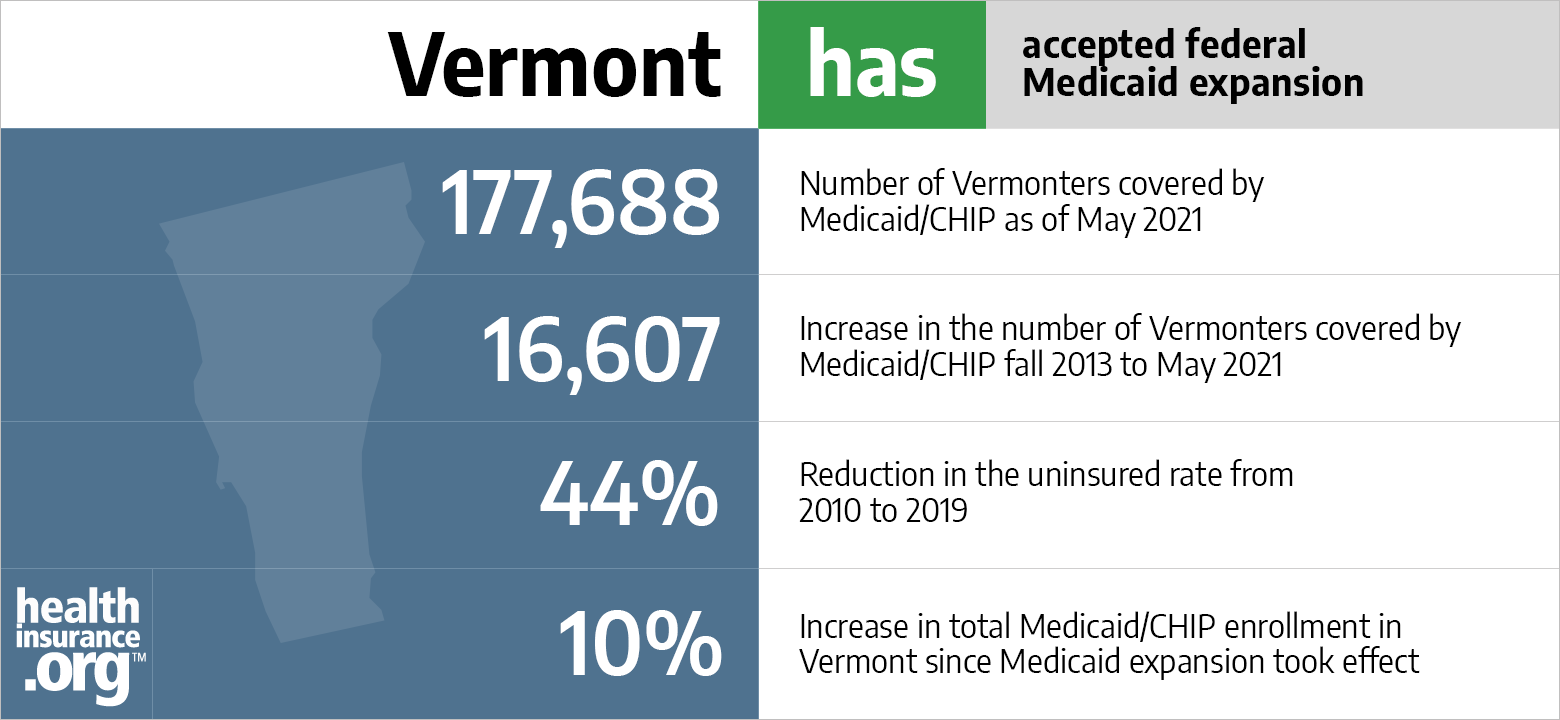

Aca Medicaid Expansion In Vermont Updated 2022 Guide Healthinsurance Org

Personal Income Tax Department Of Taxes

Vermont Income Tax Calculator Smartasset

Vermont Will Stop Updating Its Covid Case Dashboard Next Week Vtdigger

Vermont Income Tax Calculator Smartasset

Publications Department Of Taxes

Publications Department Of Taxes

1098 T Tax Information W 9s Form Bursar S Office Virginia Tech

Personal Income Tax Department Of Taxes

Vermont Sales Tax Small Business Guide Truic

Vermont Income Tax Brackets 2020

When And Where To File Your Tax Return In 2018 Tax Return Tax Paying Taxes

Vermont Estate Tax Everything You Need To Know Smartasset

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation